How to buy a house in Australia: 7 Easy Steps to make a wise decision

Purchasing a house is one of the most difficult and perhaps stressful decisions that you will ever make. The choice to purchase a home may seem more daunting than ever as the property market is booming in Australia. Although some specifics may have changed, the fundamental principles stays the same and knowing important milestones will help you to purchase a house and make your dreams come true.

We’ve put together 7 steps to help you in making a wise decision when purchasing a home in Australia without being burdened by negotiations and financial problems:

- Prepare your family budget

- Estimate how much you can borrow

- Search for a real estate agent

- Compare bank offers and apply for a home loan pre-approval

- Select the suburb and decide what type of property you want

- Prepare to purchase

- Move to your new home

1. Prepare Your Family Budget

The very first step before making any financial decision and proceeding to buying a home is drafting a budget. House purchase is a great investment in your future and you need to figure out how much you can afford paying for the loan every month. In order to answer this question you will need to have a crystal clear picture of your Family Budget.

Family Budget = Income per month – Expenses per month

Start with your total monthly income. Sum up your total monthly income after tax and don’t forget to include all other regular income streams such as rental income, dividends, bonuses, etc.

The next step is to calculate your monthly regular expenses. Generally speaking you need to sum up all living expenses that you have (such as groceries, subscriptions, phone bills, memberships, etc) and add all monthly repayments for existing loans and credits cards. Please don’t include your current rent payments into expenses if you are going to purchase a property where you want to reside.

So now if you subtract your total monthly expenses from your total monthly income and you will find out how much roughly you can afford to repay on a loan each month.

You might be interested to use the Repayment calculator on NG Loans website and get the mortgage repayments estimate. The calculations are based on the loan amount, loan duration, and the interest rate selected.

It’s worth keeping in mind that you can always book a free consultation with one of the lending specialists at NG Loans who can help you to go through all numbers and options available for you to avoid making a costly financial mistake, make sure your money is in order when you purchase a home.

2. Estimate How Much You Can Borrow

The next step is figuring out how much you can borrow. It might vary per lender as they have different rules. You can assess the maximum loan amount available for you using an online Borrowing power calculator on our website.

Prepare For Expenses

You can be surprised but apart from paying the initial deposit for the house you will need to cover additional fees (such as Stamp duty, Legal fees, Insurance, etc.). We have prepared a comprehensive guide that will help you to know more about all fees associated with a house purchase.

It is wise to leave a small buffer in your family budget, to protect youself in case of emergency or if you need extra cash unexpectedly, such as for unplanned trip. Having a buffer might give you additional comfort and help avoid falling into mortgage stress.

3. Search For A Real Estate Agent

As you may have observed, there are several steps involved in purchasing a home. Although some property buyers prefer to go it alone, having a trustworthy and dependable real estate agent may make things a lot easier.

This agent will represent you all the house purchasing process, ensuring that you select the ideal property, ask the crucial questions, make an acceptable offer, bargain, and obtain all required disclosures. But, perhaps, more importantly, having a real estate specialist on your side may bring priceless peace of mind.

Furthermore, once you've decided on the ideal agent for you, they'll go through your clearance letter, review your budget, and assist you in determining your priorities.

The mortgage brokers at NG Loans will be happy to navigate you along the whole process and provide you with some recommendations where you can find reliable Real estate agents.

4. Compare Bank Offers And Apply For A Home Loan Pre- Approval

Choose the Bank and find out what they are offering

Before proceeding with any lender we would strongly recommend you to shop around and choose the best option suitable for all your personal needs. It’s essential to do your research and investigate more about loan market propositions. Don’t afraid to contact banks directly and ask all questions that you don’t understand. The more time you invest in this research the more comfortable you will be eventually.

Sometimes it is very challenging to make a final decision as home loan products look the same or very similar to each other. We would recommend you to pay attention to some details:

- Interest rates (comparison rates)

- Upfront and ongoing loan fees

- Product Features (mortgage offset account, redraw facility, etc.)

- Loan structure (fixed or variable)

- Additional bank’s requirements (acceptable type of property, income, etc.)

If you find it difficult or time-consuming, Mortgage brokers at NG Loans will be happy to help you to choose the best option tailored to your personal needs. Contact us and book a free consultation if you want to get sharp rates today.

Apply for a home loan and obtain pre-approval

Before you start looking for a property it is strongly recommended to obtain a conditional approval or approval in principle from the bank. The lender needs to review all your financial documents and other information prior granting pre-approval.

Pre-approval lasts approximately from three to six months and bank conditionally approves you for a loan up to a certain amount with a few conditions. This means that bank will be able to fund the deal if you meet certain conditions once you find the property. One of the most popular conditions is property valuation as lenders wish to ensure that a buyer is not overpaying for the property and bank can accept this type of property in line with their policy.

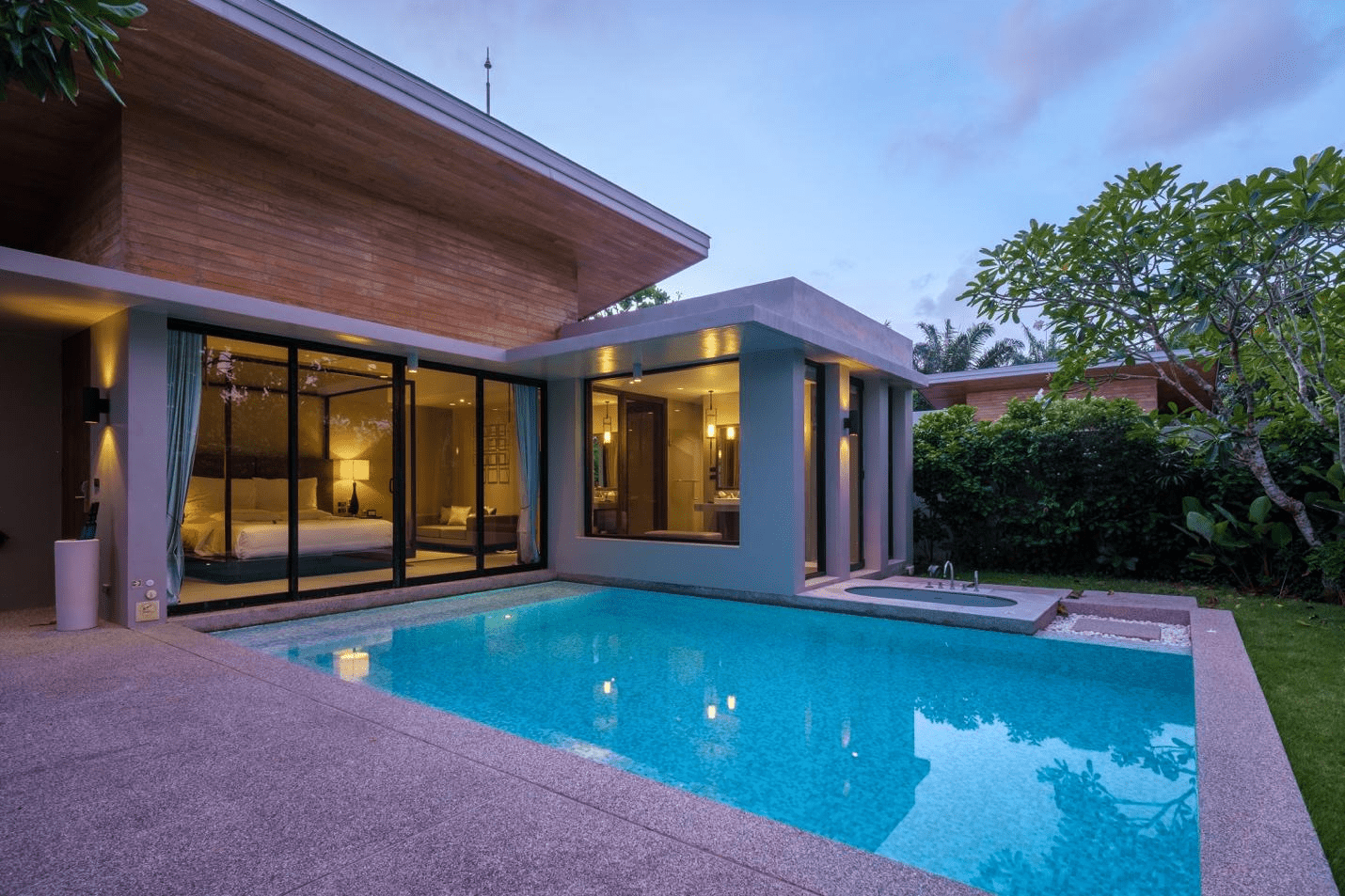

5. Select the Suburb and Decide What Type Of Property You Want

Now you are ready for shopping!

First you need to select the suburb. It is crucial to make sure that area you choose to live in suits your lifestyle. Consider your personal priorities and check the prices in several suburbs. You can order a free property report on our website and get a better idea of what a home may be worth in different parts of the city.

Here are some things that can help you to choose the right suburb:

- Reviews from residents

- Public transport

- School Zones

- Shopping centers and local amenities

- Safety

- Planned developments

- Health facilities

- Parks and recreational zones

- Internet connection

- Density and population growth

Once you know where you want to live in it is not so hard to decide what kind of house you need to buy.

5 useful tips when you’re looking for a new home:

- Decide whether you want to purchase a new house or ready to renovate

- Determine the size of the property (consider your lifestyle and the home size required to live peacefully and comfortably)

- Attend open days and inspect different houses (check for wall cracks, faulty wiring, rusty roofs and gutters, mould)

- Obtain the building and pest reports (reports will give you a better understanding of issues that you can’t see while inspecting the house)

- Visit the houses at different times and check traffic during a week

6. Prepare To Purchase

A qualified conveyancer can handle inspection requests, contract exchanges, and legal searches. Once you've discovered the home you desire, acquire a property appraisal to assist you in deciding how much to offer. You can obtain a free property report using our online platform. Please feel free to leave your enquiry online and obtain a report in 24 hours.

Finally, you're ready to bid! You risk losing out on more significant bids if you offer less than 5-10% of the appraised value. When you've settled on a price, inform the agent of your willingness to pay your deposit.

During the next few weeks between settlement, you should be busy organizing the remainder of the sale price by finalizing the financing and completing the Mortgage.

If you change your decision within this time, you may cancel the transaction, but you may be charged a penalty.

7. Move To Your New Home

You're almost ready to move into your new house! You will now need to organize your utility bills, pack your stuff, and potentially hire a removalist and a cleaning! Don't forget to update the address on all of your accounts and set up mail redirection.

Congratulations on the successful purchase of your dream home!

Summary

Buying a home is an outstanding achievement in life, though it takes considerable effort and time to deal with. It might be daunting, but it doesn't have to be if you empower yourself with the appropriate information and tools.

Moreover, by following this step by step guide and working with NG Loans you will be able to concentrate on what is most important when buying a new home.